Nigeria’s estimated population of 218,514,212, per the World Bank, has an estimated 54% living in urban areas. This urban population is slated to continue to grow, in line with the country’s population. The population growth has led to a housing deficit of over 28 million which is a reflection of the low homeownership rate in Nigeria, as estimated by the Federal Mortgage Bank of Nigeria (FMBN) and the International Human Rights Commission (IHRC). This deficit works in tandem with an unemployment rate of nearly 33% to produce a sizable number of slum dwellers.

A major hindrance to the country’s plans to provide housing will be the struggling economy. As of the time of writing, Nigeria is dealing with a 22.79% inflation rate. This is particularly problematic for the real estate sector, as the growing cost of building supplies has deterred developers.

Falling oil production and exports have reduced revenue and foreign exchange earnings. This has inadvertently affected the exchange rate, another shock to the cost of developing property. Rising energy costs have seen the prices of building materials manufactured in the country also rise.

Take, for example, the cost of paint. 20kg of paint has seen its cost go up between 50-85 percent from pre-2022 prices. A 50kg bag of cement has seen its price increase by up to 47 percent, depending on the location of purchase. Reinforcing iron rods have seen prices go from ₦350,000 per Tonne in 2021 to ₦488,800 by the end of 2022.

The difficulties that real estate development has faced in the last eighteen months are reflected in the sector’s real GDP growth rate. While the sector’s growth has stayed positive, real GDP growth has declined from 4.44 percent in Q1 2022 to 1.70 percent in 2023’s corresponding period.

The government made an allocation of ₦1.24 trillion, 5.7% of the national budget for Works, Housing, Power, Transport, Water Resources, and Aviation. A further study of the budget reveals that N356.03 billion is appropriated to the Ministry of Works and Housing, with final estimates for housing being set at ₦45 billion.

This figure is a far cry from the N21 trillion which the federal governments Bank of Industry estimated will be needed to close the housing deficit. All of these make it difficult for the country to close the housing deficit, a burden which will then fall largely on the private sector.

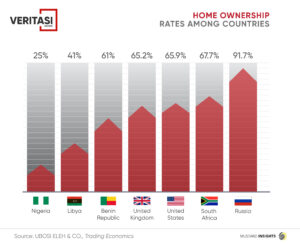

Over 60% of Nigeria’s population is living under the US$2-a-day poverty line, and the major routes to home ownership remain either the outright purchase of homes or the purchase of land and personal construction. These contribute to the country’s low homeownership rate of 25 per cent, per the Association of Housing Corporations of Nigeria (AHCN).

Nigeria’s 25% home ownership rate stands in stark contrast to a country like South Africa, where there is a home ownership rate of 67.70%, or Egypt’s 76%. One system these countries have used to achieve this is the existence of mortgages. Mortgages have historically been a pathway to home ownership, especially for the middle class who may not be able to pay cash upfront for a home.

South Africa and Egypt have large mortgage industries providing loans to potential homeowners. As of 2022, South Africa has 1,663,885 mortgages worth $68.56 billion. Nigeria, by comparison, has 32,260 mortgages worth $2.2 billion. This shows a clear issue with access to finance.

For most Nigerians, the only path is through Primary Mortgage Banks (PMB), through which the Federal Mortgage Bank of Nigeria (FMBN) makes 6% loans available, and commercial banks, where mortgage rates can go as high as 28%. By contrast, the average credit interest rate in South Africa is 11.75%.

Another contributing factor is the country’s underdeveloped Real Estate Investment Trusts (REITs) industry. REITs are corporations or trusts which are akin to institutions such as hedge funds or pension funds. They pool the capital of investors and use them to own and operate real estate. This way, individuals can invest in real estate without having to own any property.

Nigeria presently has only three REITs listed on the Stock Exchange (NSE), with a value of $200 million. South Africa has up to 30 REITs listed on the Johannesburg Stock Exchange (JSE) worth up to $19 billion.

However, in recent times, the amount accessible to contributors has moved to N50m- a big opportunity for home buyers to get the home of their dreams.

The low home ownership rates in Nigeria can largely be attributed to a large percentage of the country’s population living in poverty, a struggling economy, a reliance on imports and large energy costs leading to high purchase prices on building materials, and a lack of access to finance.